About Interpretation of the tax exemption policy for photovoltaic panels

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit.

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit.

The tax credit expires starting in 2035 unless Congress renews it. • There is no maximum amount that can be claimed. Am I eligible to claim the federal solar tax credit? You might be eligible for this tax credit if you meet all of the following criteria: • Your solar PV system was installed between January 1, 2017, and December 31, 2034.

The answer depends heavily on your specific circumstances. The IRS states in Questions 25 and 26 in its Q&A on Tax Credits13 that off-site solar panels or solar panels that are not directly on the taxpayer’s home could still qualify for the residential federal solar tax credit under some circumstances.

The two tax exemptions — property and sales — are applicable to individuals and companies that install solar energy panels onto a property. How to Claim Tax Exemptions. To make a claim, you need to file an IRS Form 5695 in addition to your tax return. You’ll then calculate the credit on Part I of the form and submit the final result in .

Sales and property tax exemptions for home solar panels (some states provide both) help keep costs lower and the payback period—the time it takes for energy savings to surpass the initial investment of the system—shorter. Knowing what you owe and what you will owe, including to the government, is a definite factor in helping you make the .

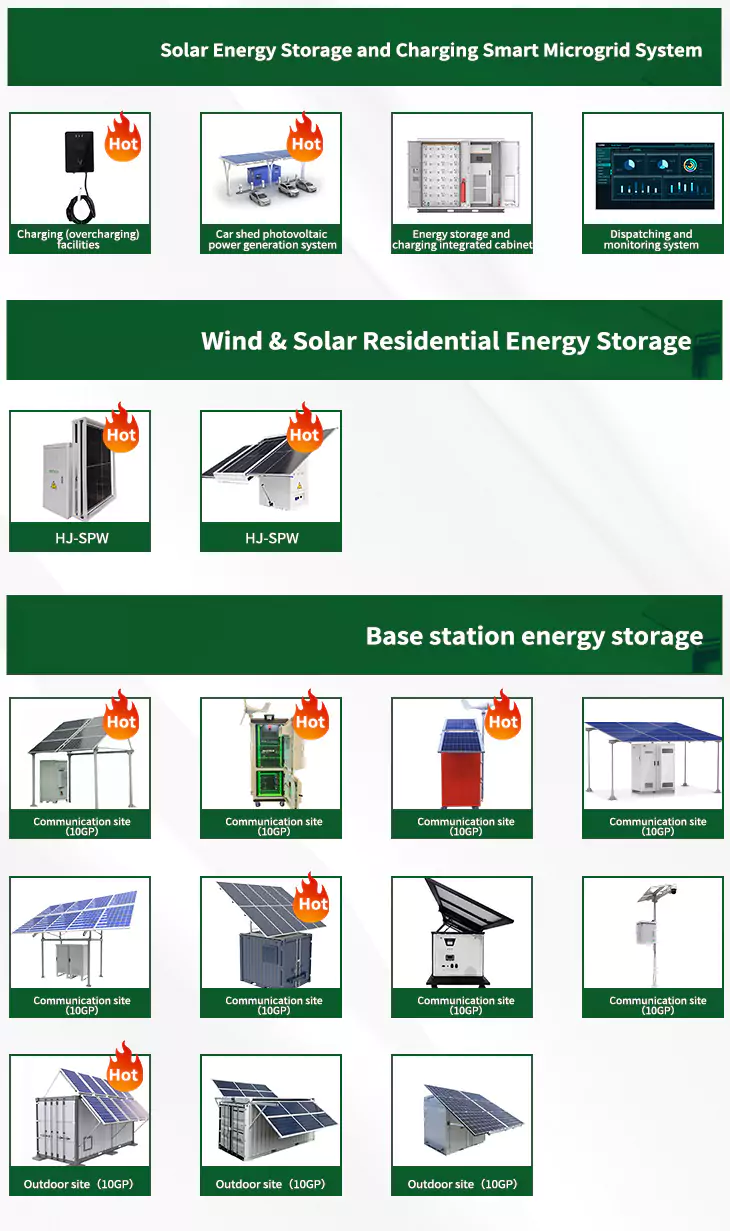

As the photovoltaic (PV) industry continues to evolve, advancements in Interpretation of the tax exemption policy for photovoltaic panels have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Interpretation of the tax exemption policy for photovoltaic panels for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Interpretation of the tax exemption policy for photovoltaic panels featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Interpretation of the tax exemption policy for photovoltaic panels]

What are solar property tax exemptions?

Solar property tax exemptions give homeowners the right to remove the added value of a solar panel system from the valuation of their home for tax purposes.

Do solar panels qualify for a tax break?

Whether you’re looking to install solar panels, invest in a solar plus storage system or add a battery to an existing system, you may qualify for a tax break from the government. The residential clean energy credit is one of the best incentives available to taxpayers who own their solar panels or other clean energy equipment.

What is the federal solar tax credit?

What is the federal solar tax credit? • The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic (PV) system.2 (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.)

Are solar projects tax deductible?

Aside from the Solar Investment Tax Credit (ITC) provided by the federal government, which covers 30 percent of your solar project's cost in income tax credits, many states offer their own tax incentives to help you go solar. One popular incentive is a solar property tax exemption.

Can you get a tax credit if you install a solar system?

a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit. ...I installed solar PV on my vacation home in the United States? Yes. Solar PV systems do not necessarily have to be installed on your primary Solar PV system on a home in the Ozark Mountains.

Do you owe property tax on solar?

However, suppose your state has a solar property tax exemption policy. In that case, you are exempted from paying that extra $225 in taxes – you don't owe any more property tax than usual, even though your home is now markedly more valuable. Your tax savings will vary depending on how much value solar adds to your home.

Related Contents

- Solar panels and photovoltaic panels tax rebate calculation

- Land use tax for photovoltaic panels

- New policy for photovoltaic panels

- Is there a tax rebate for export of photovoltaic panels

- Subsidy policy for installing photovoltaic panels in factories

- What is the tax rate for engineering photovoltaic panels

- What is the export tax rebate rate for photovoltaic panels

- Is there a tax rebate for export of JinkoSolar photovoltaic panels

- Can grapes be grown next to photovoltaic panels

- What are lithium battery photovoltaic panels

- How to install photovoltaic panels so they don t get crooked

- Home photovoltaic panels connected to the grid