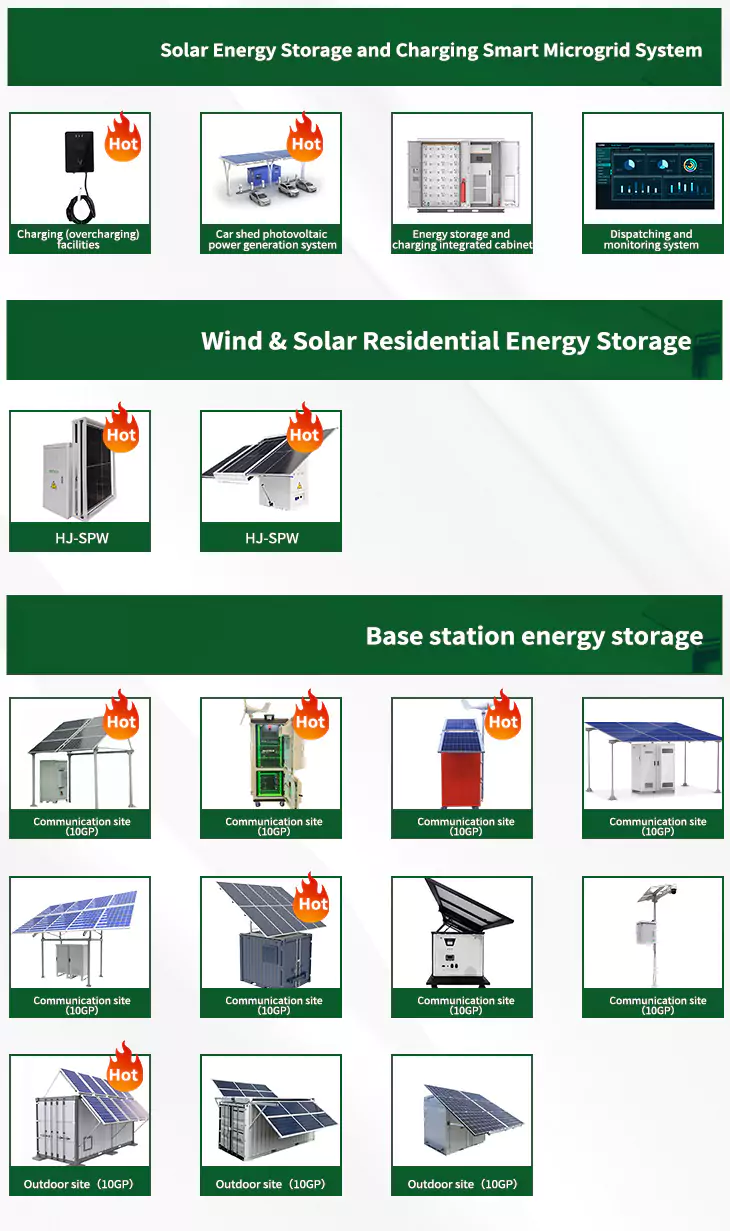

About Photovoltaic group inverter stock

As the photovoltaic (PV) industry continues to evolve, advancements in Photovoltaic group inverter stock have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Photovoltaic group inverter stock for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Photovoltaic group inverter stock featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

6 FAQs about [Photovoltaic group inverter stock]

Does SolarEdge sell current inverter systems?

SolarEdge sells current inverter systems for solar installations, allowing the panels to alternate current or AC power that is transmissible across the energy grid. It also offers power optimizers, “smart energy” management tools, energy storage solutions and other add-ons that help make the most of solar arrays.

Why are solar energy stocks growing?

The industry's technological advancements and decreasing production costs make solar energy increasingly competitive against conventional energy sources. In addition, government incentives, supportive policies and increasing consumer demand for sustainable energy further drive the growth prospects of solar energy stocks.

Why are solar stocks a bearish investment?

The high-interest rate environment made a bearish case for solar stocks throughout the year due to a demand drop among retail customers. Moreover, California’s Net Energy Metering 3.0 policy has reduced incentives for rooftop solar owners drastically.

Are solar stocks a risky investment?

In such an environment, solar stocks as a group remain higher risk than other sectors on Wall Street. Still, the long-term promise of solar remains significant in the age of climate change – so many investors are eager to get a foothold in the industry, regardless of the challenges.

How do government policies and incentives affect solar stocks?

Dependence on government policies and incentives: Solar stocks remain susceptible to fluctuations in government policies and incentives that promote renewable energy adoption. Changes in subsidies, tax credits, or regulations can significantly affect the economics of solar projects and the demand for solar technology.

Is solar energy a good investment?

Solar energy represents an enormous market opportunity. To decarbonize the economy, the U.S. needs to invest an estimated $1.2 trillion in solar energy developments alone through 2050. Meanwhile, the global investment opportunity for solar is even larger. Many companies focus on solar energy and should benefit from the sector's growth.

Related Contents

- The first stock of photovoltaic power inverter

- Jinlang Photovoltaic Inverter Stock

- Where is the best location to install the photovoltaic inverter

- Photovoltaic power generation Huawei inverter official website

- Photovoltaic inverter warranty standards

- How to choose a photovoltaic inverter

- Photovoltaic grid-connected inverter parallel phase sequence

- Where to put the photovoltaic inverter

- How to start the photovoltaic inverter

- Island photovoltaic power inverter price

- What is the alias of photovoltaic inverter

- Installation diagram of Chint photovoltaic inverter